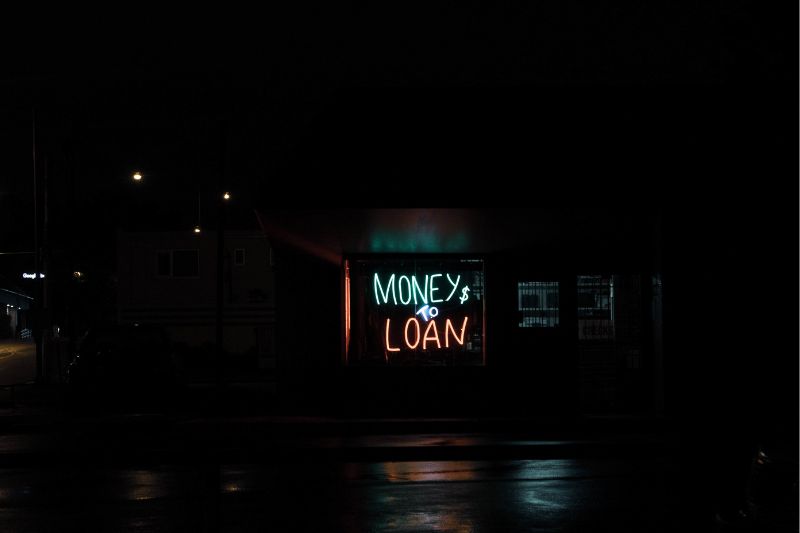

Everything To Consider Before Getting a Personal Loan

As the cost of living rises, people find it hard to stay within their budget, let alone pay for extras that inevitably creep up and require you to apply for a personal loan. Sometimes, despite your best efforts at managing your budget, there is not enough money to cover all your bills, or you’re hit with an unplanned expense like a broken down car or vet bill and don’t have the funds to pay for it.

In such cases, a personal loan can help you meet your financial obligations, but before applying for a personal loan, there are some things you must consider.

The Amount You Need

Firstly, you must work out how much money you need. Normally, the smallest loan amount you can get from a traditional lender like a bank is about $500. While you can get smaller amounts from other lenders, the terms may not be favorable, so if you need an amount less than $500, consider the urgency. If you can pull it off without any negative implications, it may be better to work towards saving up the amount. However, if you need the money to pay an urgent bill or an emergency, consider borrowing it.

Credit Score

Your credit score influences the kind of loan you will get. If you’ve got a good credit score, which is above 600, you can secure a decent loan with a low-interest rate and reasonable payment terms. If your credit rating is low, you may not be eligible for a loan from a traditional lender and may have to opt for other avenues like no credit check loans from private or online lenders. Several factors determine your credit score, including:

- Payment history

- Amount of money you owe

- Length of credit history

- Credit mix

- New credit applications

How Soon You Need the Funds

Some lenders take longer to process loan applications, so you must consider this if you need money quickly. When you apply for a loan at a bank, it can take one to seven days before you receive the funds.

If you need the money quickly, looking at other options like a fast loan advance or withdrawing funds from your credit card might be better.

Costs of the Loan

When you need a loan for an emergency, it’s normal not to consider all the expenses involved and whether you can afford them. Apart from the amount you borrow, you will also have to pay interest and fees. It varies depending on the lender and your credit score. Even if you need the cash quickly, you must carefully review the costs of the loan and the repayment term to make sure you can comfortably repay it.

Regarding the loan term, many people may feel it’s more manageable to pay lower monthly installments over a long period – which can be between five to seven years. While it may seem easy to fit into your budget, low monthly installments with a longer repayment term usually have higher interest rates than higher monthly installments with a shorter term. Because of this, you end up paying more in the long run.

Type of Loan

There are several types of personal loans available, designed for people with different financial goals and credit scores, so you must do your research and apply for the ones that best suit you.

If your credit score is high, you can easily qualify for a loan from a bank. There are two main types:

- Secured loans

You will need to provide an asset that can be used as collateral. Common assets include your vehicle, home, or investment. Putting an asset down as collateral will lower your interest rate, but if you default on your payments, you risk losing your asset.

- Unsecured loans

This option is ideal for people with excellent credit scores. You aren’t required to provide collateral, but the interest rate is higher as it’s riskier for the lender.

Folks with a poor credit rating may not qualify for a loan from a traditional lender but can consider the following:

- Co-signed loans

If you’re applying for a co-signed loan, you will need a family or friend with a good credit score to co-sign the loan. The co-signer won’t have access to the funds but will be responsible for repaying the loan should the borrower not make payments.

- Payday loans

A payday loan could be an option if you need money quickly and have a poor credit score. Applying for this loan is quick and easy, and you can be approved within minutes and receive the funds on the same day.

Expect to pay high-interest rates, and remember the loan will have to be repaid within two to four weeks, so you must think carefully before taking this loan. To apply for a payday loan, you need to be at least eighteen years old and show that you have an income. You must also provide your phone number, checking account details, and identity document.

References:

- Cnbc: 10 Questions to Ask Before You Take Out a Personal Loan

- Forbes: 5 Personal Loan Requirements

- Bajajfinserv: 6 Important Things to Know Before Taking a Personal Loan

Leave a Reply